Sell the Gift

Gonzalo Garcia – When advising clients on estate planning, advisors, clients, and their families would be well served to focus on gift planning.

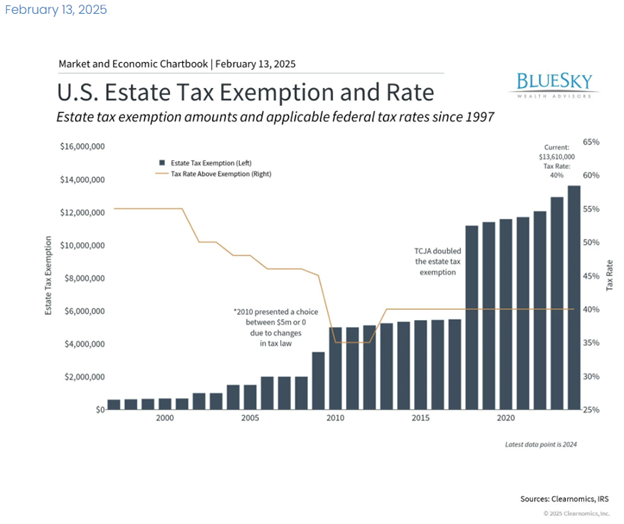

The term “estate planning” is often interpreted as “estate tax planning” for High-Net-Worth individuals and\or families, specifically those that have a net worth more than the Federal Estate Tax exemption, currently $13,990,000 ($27,980,000 for married couples) in 2025. This amount will go up to $15,000,000 for individual taxpayers and $30,000,000 for married couples with the passing of the One Big Beautiful Bill Act of 2025 and is incorrectly deemed as “permanent”. The reality is that this only means that the Federal Estate Tax exemption will not sunset as it was scheduled to do at the end of 2025.

Historically, the Federal Estate Tax exemption and the rate of tax have been a political bargaining chip for years. If you look back to 1916 when the estate tax was first enacted and forward to today, you will see many changes depending on which political party was able to move their own agenda. I am sure that the future will be no different.

That said, I think that it is safe to say, that to most people in the United States today, the federal estate tax is not a concern. In fact, it is estimated that only one quarter of one percent (.25%) of the US population will have to file an estate tax return and even less will have to pay a tax.

The Federal Gift Tax exemption, which is intrinsically related to the Federal Estate Tax is where the planning opportunity is. Let’s unpack this.

A Primer – Estate Tax vs. Gift Tax

The Federal Estate Tax and the Federal Gift Tax have the same amount of exemption. What that means is that any US taxpayer can gift $13,990,000, as an individual, to anyone they choose or to an irrevocable trust, and file a gift tax return (IRS Form 709) reporting the gift. A gift tax return is only required for gifts over the annual exclusion amount, which is currently $19,000.

Once the lifetime gift has been made (and reported) in excess of the annual exclusion amount, the Federal Estate Tax exemption is reduced by said amount. To explain it a different way, if a US taxpayer reports a gift of $13,990,000 in 2025 the remaining Estate Tax Exemption for that year would be ZERO at death, unless otherwise increased by the allowable indexing amount, typically in the following year.

So that begs the question, why don’t High Net Worth people (defined by more than the exemption amount) make gifts every chance they get, whether annual exclusion gifts, or a more meaningful use of the Lifetime Unified (Estate and Gift Tax) Exemption? There may be several reasons:

- They don’t want to lose control of the asset because once it is gifted to another individual or to an irrevocable trust, the asset is no longer theirs to enjoy (think gifts of cash, investments, real estate, privately held stock, etc.);

- They feel that they could need the asset for lifestyle\retirement at some future point in time; and/or

- They don’t understand how gifting works.

This is where an estate planning practitioner may be helpful.

For the rest of this discussion, let’s assume we are talking about an individual who is considering a gift to an irrevocable trust for the benefit of their spouse, children, possibly grandchildren and future generations, such as in a dynastic trust.

The most important concept that people need to understand with respect to gifting is that EVERY dollar gifted today, PLUS any growth on that dollar, is forever removed from their taxable estate. Think of someone throwing money over a wall from their taxable into their non-taxable estate.

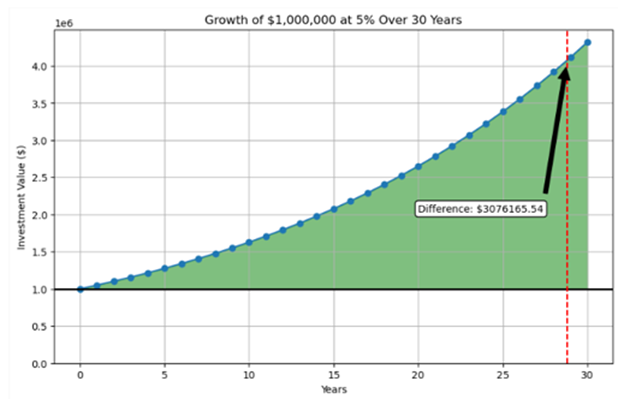

If you think of the fact that money doubles every 14.4 years at 5% (Rule of 72), in 28.8 years, a $1,000,000 gift to a trust will grow to $4,000,000. If the individual is 60 years old, that is at around life expectancy. The increase of $3,000,000 is not taxed for Federal Estate Tax purposes. Had the money been left in the estate, it would be taxed at 40% in today’s environment. If the individual is younger or lives longer, the benefit will simply compound further.

Imagine the impact of gifting the entire Gift Tax Exemption amount of $15,000,000 in 2026. That gift would have the potential to double and then double again using the Rule of 72 at 5% in the same 28.8 years. That is $60,000,000 FREE FROM ANY ESTATE TAXES, regardless of what the politicians in DC decide to do with the Federal Estate Tax regime.

Further, be mindful of any states that also have a wealth transfer tax. There are 17 states that have a wealth transfer tax of some kind and varying degrees of exemptions and tax rates. For more detailed information, please see Estate and Inheritance Taxes by State, 2025.

Once people understand this concept, the likelihood that they will engage in gifting will greatly increase. But it doesn’t have to be all or nothing, or even all at once. If the financial wherewithal of an individual or family only permits annual exclusion gifting, or some modest amount of exemption gift, or some combination thereof, that works as well.

Losing Access to the Asset

While not the main subject of this article, the concern of losing access to the funds if needed at some future time can be overcome simply by creating trusts that have Spousal Access Provisions.

LegalClarity.org describes the Spousal Lifetime Access Trust (SLAT) as follows:

“A SLAT operates by transferring assets from the grantor into the irrevocable trust, which constitutes a completed gift for tax purposes. This transfer effectively removes the gifted assets from the grantor’s individual taxable estate. The beneficiary spouse can then access trust assets for their health, education, maintenance, and support (HEMS standard), or according to other defined terms within the trust document. This arrangement provides the grantor with indirect access to the assets through their spouse.

A primary estate planning effect of a SLAT is the exclusion of these transferred assets from the grantor’s taxable estate. This exclusion can also extend to the beneficiary spouse’s estate, depending on how the trust is drafted, thereby reducing potential estate tax liabilities. Upon the death of the beneficiary spouse, the remaining trust assets typically pass to the designated remainder beneficiaries, such as children, outside of the probate process.”

Competent tax counsel should be consulted when drafting a SLAT.

How Life Insurance Plays into Planning

Notice that so far I have not even mentioned life insurance. The bottom line is that life insurance as a trust asset for liquidity purposes can be a very effective strategy. It can also provide a foundation for a broader trust investment portfolio.

Assume that an individual chooses to give $1,000,000 to a trust and that this money is invested earning 5% (dividends, interest, capital gains, etc.). That is $50,000 of income per year. If we simply peeled off the returns of $50,000 per year to purchase a permanent Universal Life policy, it would purchase $3,245,253 of life insurance on a 60-year-old male at preferred rates AND the trust would also have the $1,000,000 invested with some possible capital appreciation beyond the 5% assumed return. The insurance alone creates a 5.34% TAX-FREE rate of return at death assuming death at age 88; that is a pre-tax equivalent of 8.90%. The individual could also choose to make annual gifts of $50,000 to the trust and leave the $1,000,000 in their estate. Please note that the $1,000,000 asset value would be subject to a 40% federal estate tax and hence worth only $600,000 to the heirs.

Alternatively, if the policy was paid as a single premium of $1,000,000 using a Guaranteed Variable Universal Life (GVUL) policy, assuming a 7% return net of fund management expenses, it would purchase a guaranteed death benefit of $2,541,431 but with investment growth could be worth $4,464,519 at age 88. This is a 5.49% TAX FREE return or 9.15% pre-tax return.

These are not unattractive as a “safe money” option and the great thing about life insurance is that it does not care what is going on in the capital markets – it is uncorrelated to any other asset class. It is worth exactly the death benefit, tax-free and fully liquid at the time of the insured’s death, when it is needed.

See comparison below of a particular carrier’s insurance solutions using both the $50,000 annual premium and the single premium of $1,000,000. These do not constitute the entire market of insurance companies or product solutions available and are for comparative purposes only.

There is no right answer as to product type or funding pattern and this comparison is only made available to highlight two different solutions with different funding patterns. However, what is meaningful is the following:

- Making gifts to an irrevocable trust (with or without insurance) removes assets from a taxable estate.

- All growth in the value of the gifted asset, be it stocks and bonds, private equity, commercial real estate, etc. is forever outside of the taxable estate.

- If the gifted assets or income from those assets are leveraged to purchase life insurance, either single life or second-to-die, which provides even more leverage than the example provided, the value of the trust can be further enhanced.

Consumers with taxable estates, who can comfortably afford to “throw bags of money over the wall” should be educated on the value of the very attractive Federal Gift Tax exemptions that exist today and were made even more attractive with the passing of the ONE BIG BEAUTIFUL BILL ACT of 2025.

Contact the AgencyONE Advanced Markets Team at 301.803.7500 for more information or to discuss a case.