Two Alternatives to a Non-Qualified Deferred Compensation Plan

Gonzalo Garcia – In the April, 2025 Advanced Markets ONE Idea from AgencyONE, it was discussed that there would often be calls from advisors saying that their client, “John”, an S-Corp owner, wants to implement a Non-Qualified Deferred Compensation (NQDC) Plan and that after some discovery, a NQDC Plan may not be the best solution.

By way of summary, the case study in the ONE Idea revealed that:

John is 100% owner of an S-Corporation and:

- Takes a $250,000 salary (W-2 income) from the business;

- Has payroll expense for his employees of $1,000,000, of which

- A key employee, Jill, is $200,000 of that and;

- 10 other employees are paid the remaining $800,000; and

- After deductible expenses, John has a profit of $500,000 which is reported as “pass-through” income to him on IRS Schedule K-1 of Form 1120-S.

The ONE Idea explained all the reasons why a NQDC Plan would not work from a tax perspective for John personally. This article will focus on John’s goal to retain and reward his key employee – Jill.

Jill is a valuable employee, and John is relying on Jill’s expertise to continue to help him grow his company for an eventual sale prior to his retirement. However, John does not want to make Jill a shareholder, thereby diluting his ownership. John is willing to allocate $100,000 per year to a retention plan for a period of 10 years.

John has decided that instead of paying Jill additional cash compensation, he would like to set up a plan that will reward her for staying with his company, helping him grow and sell the company within the next 10 years.

I would offer two solutions in a situation like this, depending on how important tax deductions are to John.

Solution #1 – Current tax deductions are important to John

If John is unwilling to use non-deductible dollars, such as in a Non-Qualified Deferred Compensation Plan or a Split Dollar Plan, a Bonus Arrangement with a Tax Loan may be an ideal solution. How does that work?

In this scenario:

- John’s contributions to the plan are $1,000,000 over the 10-year period.

- John will enjoy a 37% income tax deduction as a compensation expense to Jill. His total after-tax outlay is $630,000.

- Additionally, John lends Jill $30,000 to pay her income taxes each year (assuming she is in a 30% tax bracket) and charges her 5% interest on the loan, which is accrued and payable at the end of the 10 years.

- At that time, Jill takes a distribution from the policy in the amount of Principal and Accrued Interest in the amount of $396,204 to pay John back.

- Total interest income to John equals $96,204, which is subject to a 37% income tax to John, resulting in $60,608 to John after taxes are paid.

- John’s total outlay after taxes is $569,392 over the 10-year period.

- Jill’s residual cash value in the policy is $904,130, which grows to $1,596,579 at her age 65.

- Jill then enjoys a tax-free income stream of $140,076 for 20 years, with a residual death benefit to her family.

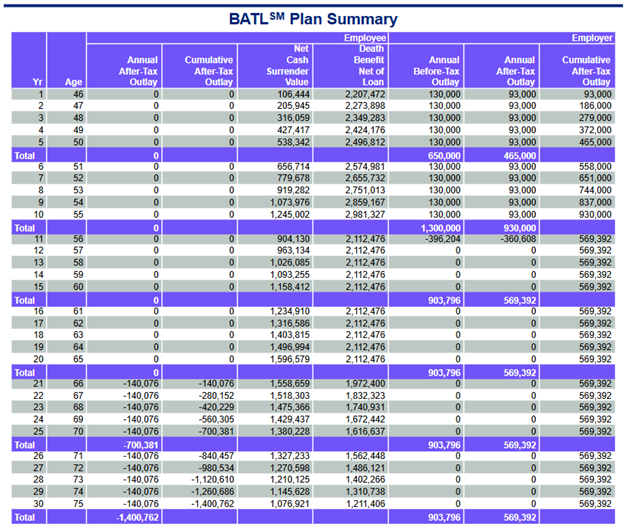

The chart below provides more detailed numeric information. It is important to note that a high early cash value policy has been used, providing immediate liquidity in the event of early surrender of the policy.

Solution #2 – Current tax deductions are not important to John

If current tax deductions are not important to John, he could purchase a corporate-owned insurance policy on Jill’s life under a Split Dollar arrangement, endorsing a portion of the death benefit to Jill for her family and retaining a portion of the death benefit for Key Person purposes. As previously stated, Jill is a very key and valuable employee to John’s company. They essentially “split the benefits” of the policy.

For the death benefit to be tax-free to Jill’s beneficiaries if she were to die prematurely, she must report an economic benefit to the IRS and pay taxes on that economic benefit. It is a small amount per year. How does that work?

In this scenario:

- John’s company applies for life insurance coverage on Jill and enters into a Split Dollar Agreement with her.

- John pays $100,000 to the insurance company according to the Split Dollar Agreement. This is a non-deductible expense to John.

- Because the policy is company-owned and has a cash value, John can book the cash surrender value as an asset of the company. In this case, that amount is $106,444, which provides a lift to his balance sheet.

- In the event of Jill’s death, John retains the right to a portion of the death benefit equal to the sum of his premiums paid, PLUS $600,000 of Key Person coverage on Jill. Any residual death benefit would be paid to Jill’s family income tax-free.

- Jill must report the Economic Benefit of that employer-paid life insurance coverage each year to the IRS and pay taxes on that amount for the death benefit to be income tax-free to her family.

- At the end of the 10th year, John has the right to transfer the policy to Jill as compensation, enjoying an income tax deduction at the time for the sum of the premiums paid equal to $1,000,000.

- Jill would report the case surrender value of the policy at that time as income, which is $1,245,002, and be subject to income taxes on that amount.

- Jill would take a distribution from her policy in the amount of the tax owed and would have a residual cash value of $930,379.

- The cash value will increase to $1,643,592 at Jill’s age 65, and she can withdraw $144,300 income tax-free until age 85, and a residual death benefit will go to her family.

The impact of this transaction with Jill is to essentially provide her with a “Stay Bonus” of the value of the policy if she remains with the company and generates the growth and profit objectives established by John.

Conclusion

Both of these solutions can work very effectively as an alternative to a Non-Qualified Deferred Compensation Plan with minor administrative requirements and avoiding the Section 409(A) requirements mentioned in the April, 2025 Advanced Markets ONE Idea. I hope these articles and ONE Ideas have spurred you to think about your employer and key employee clients, recognizing that there are easily implementable solutions for many situations after good fact-finding and detailed discussions regarding client goals and objectives.