Are RIAs Approaching Risk Management Correctly? What Next?

“Facet Wealth throws a lifeline to struggling ‘insurtech’ firm amid an industry shakeout; Facet is delivering a mother lode of referrals and asking nothing in return” was the headline of a recent article written by Oisin Breen in RIABiz. Read on to learn why this is both encouraging and problematic at the same time.

Earlier this year, Policygenius laid off 25% of its workforce after receiving $125M of capital funding only three months earlier. But, according to TechCrunch (www.techcrunch.com):

At the time of its Series E in March, Policygenius — whose software essentially allows consumers to find and buy different insurance products online — said that its home and auto insurance business had “grown significantly,” with new written premiums having increased “more than 6x from 2019 to 2021.”

So, what was the problem at Policygenius? In an August 2nd article in RIABiz, author Oisin Breen commented that:

“Company co-founders Jennifer Fitzgerald and Francois de Lame, now CEO and chief product officer, respectively, did not return phone calls for comment. But Fitzgerald released a statement in June blaming a “sudden and dramatic shift in the economy.”

In other news... on June 28th Bestow, a leading provider of online direct-to-consumer life insurance, laid off 14% of its staff. This after receiving over $137MM in private equity funding since 2017.

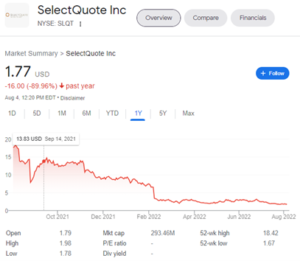

Yet, in other news, as of August 3rd, 2022. SelectQuote (NYSE: SLQT) stock price was down almost 90% in the last 12 months, and it is most likely because of deteriorating net income. Their end of Q1, 2022 Net Income was down a whopping 118.3% (a loss of $6.45MM) on revenue growth of 3.68% year over year.

What is Going On?

While I have some suspicions, I am not exactly sure what is going on, and there are many more examples of other direct-to-consumer insurance platforms suffering the same fate, but that is not the point of this article. More later.

While I have some suspicions, I am not exactly sure what is going on, and there are many more examples of other direct-to-consumer insurance platforms suffering the same fate, but that is not the point of this article. More later.

The direct-to-consumer market for life insurance has been woefully under-accomplished. There has been a lot of money being thrown at it, for sure, and some people have cashed in on a lot of money, but the results are lagging behind expectations and presenting profitability challenges.

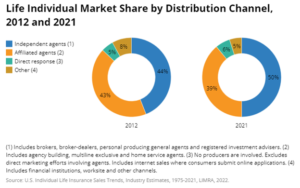

According to LIMRA, as seen in the chart below, as of 2021, “direct response” (read: direct-to-consumer) only captured 6% of the life insurance market in the United States, up only 1% since 2012, whereas Independent Agents captured 50% of the market, up from 44% in 2012.

Direct-to-Consumer’s Changing Distribution Strategy

In December of last year, Bestow entered into a partnership with financial services firm Equitable to launch Term-in-10. The Equitable website states that “Powered by Bestow’s industry-leading platform, Term-in-10SM was designed for Equitable from the ground up to combine the best of digital distribution paired with the tailored support of a financial professional.”

Bestow has also recently, in 2022, partnered with 60 Independent Brokerage General Agencies at Libra Insurance Partners to expand distribution for their products to independent agents.

In the meantime, in November 2021, Ethos, an insurtech leader, hired Marty Schafer as Chief Distribution Officer. Mr. Schafer, a seasoned insurance distribution veteran, according to the press release will “be responsible for building a team to focus on enabling partnerships specifically with third party life insurance distributors and life, property and casualty insurance agents.”

Finally, I recently received a call from another insurtech company whose name I cannot disclose, asking me if I could help them find someone with meaningful distribution experience to help them (presumably to follow in Ethos’ path) with adding third-party distribution through agents.

The old adage that “insurance is not bought, it is sold” is ringing true, and it took many millions of dollars to figure this out. Most, if not all, the Direct-to-Consumer platforms are looking at independent insurance professionals to get the lift that they so desperately need.

But What About the Registered Investment Advisor?

The same RIABiz article referenced above, which leads me to the main point of this article, announced that Facet Wealth, a $1.2B AUM Baltimore-based Registered Investment Advisor, just entered into a formal vendor agreement with Policygenius for insurance products, including life insurance. The title of the article is “Facet Wealth throws a lifeline to struggling ‘insurtech’ firm amid an industry shakeout; Facet is delivering a mother lode of referrals and asking nothing in return”.

The implication is that Facet Wealth, which has a flat-fee business model and 12,000 clients, has decided to offer insurance to their clients without any compensation whatsoever, but more importantly, is entrusting Policygenius, a “struggling” direct-to-consumer marketing organization”, with their client’s risk management needs and financial security. I applaud this move and am thrilled to see that a Fee-Only Registered Investment Advisor, such as Facet Wealth, has recognized that they need to offer risk management products to their clients and have decided to outsource this task.

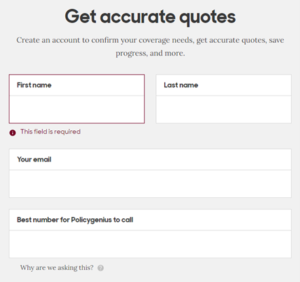

While most people would think that a direct-to-consumer website will do this for Facet’s clients without insurance agents, think again. Insurance CAN NOT be sold without an agent. There is a legal requirement for something called an “agent attestation” – see the screenshot from the Policygenius’ website, which discloses the legal requirement.

While most people would think that a direct-to-consumer website will do this for Facet’s clients without insurance agents, think again. Insurance CAN NOT be sold without an agent. There is a legal requirement for something called an “agent attestation” – see the screenshot from the Policygenius’ website, which discloses the legal requirement.

Why are we asking this?

We’re required by law to confirm your information over the phone.

You can also use this time to ask our licensed experts any questions you may have. They work for you, not the insurance companies, so their advice is unbiased — no sales pitches here.

Let’s Unpack This & Discuss What Really Happens

A client of the firm goes online to www.policygenius.com and completes the online questions and gets a quote. BEFORE they can proceed, they are asked for their name, email address, and telephone number. Do you know what happens next and why so many of these direct-to-consumers are struggling? It is called the “abandon rate” on the internet. Most people would rather get a root canal than give their email address and telephone number to an insurance agent, right?

IF the consumer provides their contact information, then the phone calls start and while the “licensed experts” can complete the application for underwriting consideration by the insurance company, they are rarely skilled in advice. Many are working the phones in a call center and trying to hit their sales goals to generate revenue for the agency, Policygenius in this case, and have metrics just like any other salesperson, for performance reviews, promotions, and incentive compensation.

But then the real work starts – medical underwriting. Clients get declined for coverage, or the pricing comes back differently than was quoted online and nobody can explain why. Maybe the client misrepresented their height and weight, or failed to disclose that they had a DUI, or that they smoke marijuana, or, or, or…

Finally, what happens when the client dies or becomes disabled, or needs long-term care? Are the “licensed experts” in a call center going to be adept at working with a family to assist during the claims process? I doubt that they will even be working there any longer.

Insurance is a messy business and as Mr. Breen adeptly points out in the opening sentence of his article:

“Insurance is a beast of business that should not be entered into lightly or unadvisedly. Everything from the initial sale to the final claims service and all the actuarial and underwriting business in-between should be handled by professionals and then hopefully sold ethically. No consumer could ever do enough due diligence to know whether they are getting a fair shake. Facet Wealth is advisedly assisting in offering coverage and just as advisedly staying the heck away from any compensation. It’s just too dicey. Ironically the insurance broker it is gift-wrapping policies for is one facing hard times — probably for the aforementioned reasons.”

BUT, What Happens If…& Your Fiduciary Responsibility

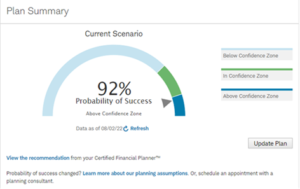

I recently completed my own financial planning with my CFP advisor (yes, I have one). The Plan Summary to the left is the bottom line of what I got …

I recently completed my own financial planning with my CFP advisor (yes, I have one). The Plan Summary to the left is the bottom line of what I got …

Good News – I am going to be able to comfortably retire someday!

BUT what happens if I live too long, die too soon, or get sick along the way? What happens to my assets when they pass to my children or grandchildren? How do they transfer? Is it by probated will, by beneficiary designation, or via a trust? How are these assets taxed for income or transfer tax purposes?

What happens if I get sued because my 16-year-old child hurt someone as he was learning to drive, or someone got injured on my property?

These things happen every day. How can we fulfill our fiduciary obligation to our clients if we ignore them? How can we ensure the completion of the financial plan that we have worked so hard to build?

My CFP has not asked a lot of those questions and I am not sure if it is because he knows what I do for a living or if he is just afraid to ask, or worse yet, does not even know to ask? I will give him the benefit of the doubt and assume it is the former. That said, I engage with wealth managers, investment managers, and financial planners every day and I am always amazed at how good they are at asset allocation and portfolio construction, at running Monte Carlo simulations, at doing cash flow planning, but many of them do not fully embrace risk management solutions or if they do, don’t want to get into the mud with their clients on these issues. Sadly, most of the financial planning software that they use does not do a good job at scenario planning on these issues either. This will be a topic for another day.

Yet, Facet Wealth just handed over 12,000 clients to a call center with “licensed experts”. I just don’t get it.

In a January 2022 US New & World Report article entitled “How to Buy Life Insurance” the author provides several wise tips for consumers.

1. Decide if You Need Life Insurance

2. Determine How Much Life Insurance You Need

3. Determine Which Type of Life Insurance Is Right for You

4. Decide if You Need Life Insurance Riders

5. Choose a Life Insurance Company

6. Purchase Your Policy

Each section is packed with useful considerations and guidance, most of which consumers would NOT know how to determine on their own. Much of which a “licensed expert” at a call center would not know how to provide advice on unless, possibly, maybe, they were skilled enough to engage in additional discovery. While many investment advisors and financial planners are familiar with much of this, they may not have the depth of knowledge that a professional risk management advisor would have to deal with in a complex and fluid market. I will restate Mr. Breen’s opening statement in his article:

“Insurance is a beast of business that should not be entered into lightly or unadvisedly. Everything from the initial sale to the final claims service and all the actuarial and underwriting business in-between should be handled by professionals and then hopefully sold ethically. No consumer could ever do enough due diligence to know whether they are getting a fair shake.”

In an article in Insurance News Net on August 1st, Jeff Waddington discusses the Outsourced Insurance Desk (OID) and states that:

“An OID, at its core, allows an advisor to access products and expertise in the risk management or insurance world when appropriate for their clients. This is important from the advisory perspective because in many cases, the fee-only advisor may not have the requisite license to provide insurance solutions or have these conversations with clients. The OID, with the expertise and proper license, can become the risk management arm of the advisory firm that advisors can leverage to benefit their clients.”

In early 2022, AgencyONE created the Insurance Network for Fiduciary Advisors because we feel that there is a better way to achieve holistic financial planning and to fulfill our fiduciary duty to our customers. Think of it as an OID, with ethical, seasoned, independent, risk management professionals, not a call center desk of “licensed experts”. These risk advisors are skilled and credentialed, vetted, and are subject to a Code of Conduct, respecting your relationship and fiduciary duty toward your clients.

Marc Cadin, CEO of Finseca is making great strides in espousing a holistic approach to wealth management and highlights an Ernst and Young (EY) study stating it is “one of the most important studies of the past several years. It exhaustively analyzed how life insurance, especially permanent policies, and deferred income annuities out-perform investment-only or investment-plus-other-products approaches, in every combination.” Mr. Cadin’s mission is to reunify the financial security profession, bringing investment management and risk management closer together in a more holistic approach to wealth management collectively. To accomplish that, we first need to consider that financial security is not just for the wealthy and those of financial means, but for ALL. (FIN-SEC-A = Financial Security for All). A collaborative partnership between investment advisors, financial planners, and risk managers will be critical to completing this vision.

For more information, please contact Gonzalo M. Garcia at 301.803.7520 or gonzalo@agencyone.net.