QLAC: A Strategy to Reduce Your Clients’ Taxes

Craig Baumgartner – Imagine asking your clients the following question: Sally and Jeff, are you interested in discussing a strategy to reduce your tax bill for next year?

Everyone is interested in reducing their tax liability! What if you offered your clients a way to pay less in taxes, while also helping to insure against living too long? A Qualified Longevity Annuity Contract (QLAC) can do just that! This article will discuss what a QLAC is, and how it works and provide a case study showing how a QLAC helped the client of an AgencyONE 100 Advisor.

What is a QLAC?

What is a QLAC?

A QLAC – Qualified Longevity Annuity Contract – is a special type of deferred income annuity, or deferred SPIA that is funded with qualified money. Your high-net-worth clients have likely built up a healthy portfolio of qualified retirement funds that they may never need to access. For many of your clients, these accounts represent an increasing tax liability as their Required Minimum Distributions (RMDs) rise each year as the accounts grow.

By purchasing a QLAC, your clients are effectively reducing the number of qualified funds that are used to calculate their RMDs. The QLAC reduces your clients’ tax liability in the near term by repositioning an asset and helps prevent them from outliving their money – “longevity insurance”.

How Does a QLAC Work?

How Does a QLAC Work?

The client makes a single premium purchase using funds from their IRA or another qualified account. At the time of application, they select an income start date as late as age 85 to begin a guaranteed lifetime income stream. While income annuities are often thought of as inflexible, they offer several ways in which your clients can customize a policy to meet their financial needs and goals. Income annuities include the option to:

- Select a future income start date, anywhere from 13 months to 40 years in the future or up to age 85;

- Elect a single or joint life payout;

- Choose a life-only payout for the most income, or choose a period certain or cash refund payout; and

- Design a policy with a guaranteed cost of living adjustment for increasing income if your clients are worried about inflation.

How Have QLACS Changed?

How Have QLACS Changed?

When the concept was first introduced in 2014, clients could use a maximum purchase premium representing the lesser of $125,000 or 25% of qualified funds. The SECURE Act 2.0 however, comes with some favorable updates to the QLAC rules and allows clients to purchase up to $200,000, and does away with the 25% maximum.

Case Study

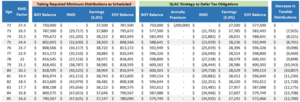

Sally and her husband Jeff are both 72 years old. They have saved and invested diligently throughout their working years and have built a comfortable nest egg for retirement. The couple’s long-term non-qualified investments have performed quite well. Although Sally and Jeff each have substantial IRAs, they will likely be able to meet their lifestyle needs by drawing down non-qualified assets. Furthermore, Sally enjoys working and plans to continue her part-time consulting work for a few more years. However, they are concerned that Sally’s consulting income in addition to their full RMDs will push the couple into a higher tax bracket. Sally and Jeff both have a family history of longevity. While their retirement income needs are met under most assumptions, they are concerned about the risk of “living too long”. When Sally and Jeff’s advisor brought up the idea of repositioning some of the assets they don’t currently need and applying those assets to a possible future need, the couple was delighted by both the potential short-term and long-term benefits. By repositioning $200,000 of qualified funds, they can reduce their tax burden in the near term and create a joint lifetime income of $3,600 per month in the long-term starting when Sally turns 85.

Sally and her husband Jeff are both 72 years old. They have saved and invested diligently throughout their working years and have built a comfortable nest egg for retirement. The couple’s long-term non-qualified investments have performed quite well. Although Sally and Jeff each have substantial IRAs, they will likely be able to meet their lifestyle needs by drawing down non-qualified assets. Furthermore, Sally enjoys working and plans to continue her part-time consulting work for a few more years. However, they are concerned that Sally’s consulting income in addition to their full RMDs will push the couple into a higher tax bracket. Sally and Jeff both have a family history of longevity. While their retirement income needs are met under most assumptions, they are concerned about the risk of “living too long”. When Sally and Jeff’s advisor brought up the idea of repositioning some of the assets they don’t currently need and applying those assets to a possible future need, the couple was delighted by both the potential short-term and long-term benefits. By repositioning $200,000 of qualified funds, they can reduce their tax burden in the near term and create a joint lifetime income of $3,600 per month in the long-term starting when Sally turns 85.

- Short-Term Benefits – Sally effectively reduces the balance of her qualified accounts, and thus the amounts used to calculate RMDs. She can defer taking approximately $100,000 of taxable distributions over the next 10 years by purchasing a QLAC.

- Long-Term Benefits – While Sally does have to pay taxes eventually on the distributions, she will likely pay them at a lower effective tax rate after she has fully retired. Furthermore, the QLAC provides a backstop of guaranteed income which protects the couple from the risk of outliving their money – no matter what happens in the markets.

Annuity rates are more competitive than they have been in recent memory! If you aren’t talking to your clients about their annuity options, someone else is! AgencyONE can help you stay apprised of the latest market, product, and legislative developments so that you can help your clients make the best financial planning decisions for their needs.