Sunrise or Sunset?

In a recent LinkedIn post, Caroline Brooks JD, MBA, Head of Advanced Markets at John Hancock, reminded us that we have less than 1,000 days until the sunset of the Tax Cut and Jobs Act (TCJA) doubling of the Estate and Gift Tax Exemption.

As many of you know, the Tax Cut and Jobs Act of 2017 (TCJA) doubled the Federal Estate and Gift Tax Exemption from $5,000,000 to $10,000,000 (indexed for inflation). In 2023 the exemption stands at $25,840,000 for a married couple ($12,920,000 for a single taxpayer) and will continue to increase until it is cut in half on January 1, 2026. This is what Ms. Brooks is referring to in her LinkedIn post. That day is quickly approaching.

Since 2017 practitioners in the world of estate planning have seen a huge increase in the transfer of assets being made via gifts, to trusts. These gift transfers are typically under the current gift tax exemption amount of $25,840,000 and based on clarifying regulation by the IRS cannot be clawed back in 2026 once the exemption drops. As such, wealthy taxpayers are or should be motivated to take advantage of this “use it or lose it” window provided by the TCJA to move massive amounts of wealth to the next generation without it being subject to the wealth transfer tax system.

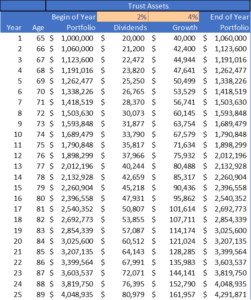

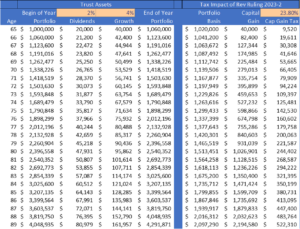

To illustrate the power of this strategy, consider the adjacent table. A couple aged 65 and 62 have gifted $1,000,000 of a managed portfolio to a trust and forever removed that asset from their taxable estate along with any growth in that portfolio. Not to get into the weeds, but most trusts are created as grantor trusts (also known as intentionally defective grantor trusts), which means that the grantor(s), the taxpayer(s) who created and funded the trust, pays the income tax due each year on any earnings of the trust, allowing trust assets to remain unencumbered by income or capital gains income taxes. This has the effect of the grantor(s) making an additional payment on behalf of the trust without having to use any additional gifting capacity.

To illustrate the power of this strategy, consider the adjacent table. A couple aged 65 and 62 have gifted $1,000,000 of a managed portfolio to a trust and forever removed that asset from their taxable estate along with any growth in that portfolio. Not to get into the weeds, but most trusts are created as grantor trusts (also known as intentionally defective grantor trusts), which means that the grantor(s), the taxpayer(s) who created and funded the trust, pays the income tax due each year on any earnings of the trust, allowing trust assets to remain unencumbered by income or capital gains income taxes. This has the effect of the grantor(s) making an additional payment on behalf of the trust without having to use any additional gifting capacity.

Now, if the trust investment portfolio grew by 4% and paid dividends of 2%, you can see that after 25 years, all reinvested dividends and capital appreciation, totaling over $3,000,000, have also escaped the wealth transfer tax system. The $1,000,000 gift has grown to $4,291,871 and will transfer to the trust beneficiaries completely estate tax-free.

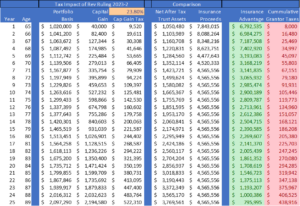

However … a recent Revenue Ruling 2023-2 as described by KPMG and in a recent WealthManagement.com article has confirmed that while estate tax-free, the trust assets do NOT enjoy a step-up in basis, as if they had been owned by the taxpayer him or herself. To illustrate the impact of this, I have created a separate chart, showing basis tracking and the ultimate capital gains tax that the trust would pay assuming a 23.8% effective rate. Keep in mind that any dividends that were reinvested increase the basis of the trust. As such, you will see that of the $4,291,871 accumulated in the trust, $2,194,580 is untaxed capital growth and would be taxed upon the death of the grantor(s), resulting in over $500,000 lost to taxes.

How could a trustee avoid this tax? Life insurance …. Yes, LIFE INSURANCE AS AN ASSET INSIDE THE TRUST. Life insurance proceeds are received by the trust free of all income and capital gains taxes, in effect providing the step-up in basis that is confirmed as lost in Revenue Ruling 2023-2.

Properly designed, life insurance can provide meaningfully more benefits to the trust beneficiaries AND eliminate the taxes paid by the grantor annually for the dividend income generated by the portfolio. Isn’t it the fiduciary duty of the trustee to manage the trust for the maximum benefit of the beneficiaries? Let’s take a look.

The table illustrates the net value of the trust after the capital gain taxes are paid. This would leave $3,769,561 for the beneficiaries of the trust, assuming the death of the grantor(s) occurring in year 25. By contrast, a well-designed 2nd to Die Life Insurance contract would provide $4,565,556 in tax-free death benefits – a gain of almost $800,000 for the beneficiaries (the green column)*. Furthermore, the use of insurance would save the grantor(s) of the trust $438,916 in cumulative income taxes paid on the dividend income generated by the portfolio in the trust throughout his, her or their lifetime. Does this alternative not help the trustee meet his fiduciary duty to the beneficiaries of the trust in a more effective manner? We believe that it does.

Of note, there is a LOT of chatter on Capitol Hill and in President Biden’s proposed tax plan that could impact grantor trusts, including potentially eliminating some of the benefits of trust-owned life insurance. Tax policy is rarely made retroactively, so back to the point of Carly Brooks’ comment on LinkedIn, time is limited, attorneys are busy, and planning for effective wealth transfer is essential as we head into the largest wealth transfer in history over the next 15-20 years. Taking advantage of creating trusts and funding them with properly designed life insurance, as illustrated above, is a prudent action.

AgencyONE’s Advanced Sales team can help. Please contact us at 301.803.7500 for more information or to discuss a case.

*For additional information regarding the design of the life insurance product referenced in this ONE Idea, along with other designs which would also be applicable, please call AgencyONE.