Dead Assets (Literally)

Gonzalo Garcia – As many of you know, I spend a lot of time on the phone with financial advisors assisting them in defining ways to mitigate risks resulting from mortality, morbidity, longevity, and taxes. During a recent call with an investment advisor and one of our AgencyONE risk advisors, I came across a fact pattern that I feel compelled to share.

The PROBLEM

The only way that I can describe what we discovered in the clients’ financial profile was that the couple had been extremely successful in their financial and investment planning. They have a net worth of $40,000,000, and one is still working (and making $1,000,000 pre-tax) at age 75. The clients’ asset base was comprised of $10,000,000 in a non-qualified managed portfolio and a $5,000,000 home. The PROBLEM was that of the remaining $25,000,000, $10,000,000 of the couple’s assets were in IRAs ($1,000,000 in Roth IRAs) and $15,000,000 in Variable Annuities. Clearly, the couple had done “all the right” things.

You may be humored by my choice of the word “PROBLEM”, but let’s unpack this because at age 75 and age 73 respectively, this couple, or better said, their estate …. their children and grandchildren, were facing a very severe threat of confiscation by their other beneficiary, the IRS.

Additional Details

The clients “burn rate” for living expenses is approximately $500,000 per year after taxes and we assumed a 3% inflation rate. Our priority is that all living expenses are met to maintain the lifestyle the couple are accustomed to and that the income-producing, or other available assets, are sufficient to accomplish that goal. The investment advisor felt comfortable using a 6% gross rate of return for the IRAs and Variable Annuities and a 6% total return (2% dividends and 4% growth) for the non-qualified assets. The husband intends on working until age 80 at his current income rate. While continuing to generate a meaningful income, it is important to note that the couple was also taking Required Minimum Distributions from their IRAs and both were already taking Social Security benefits, which were all modeled into the analysis. Finally, this couple had already taken advantage of the lifetime gift exemption to transfer approximately $8,000,000 out of their estate and into trusts for their 3 adult children, leaving them $15,400,000 of available gift tax exemption in 2021.

Projection of Estate & Cash Flow Analysis

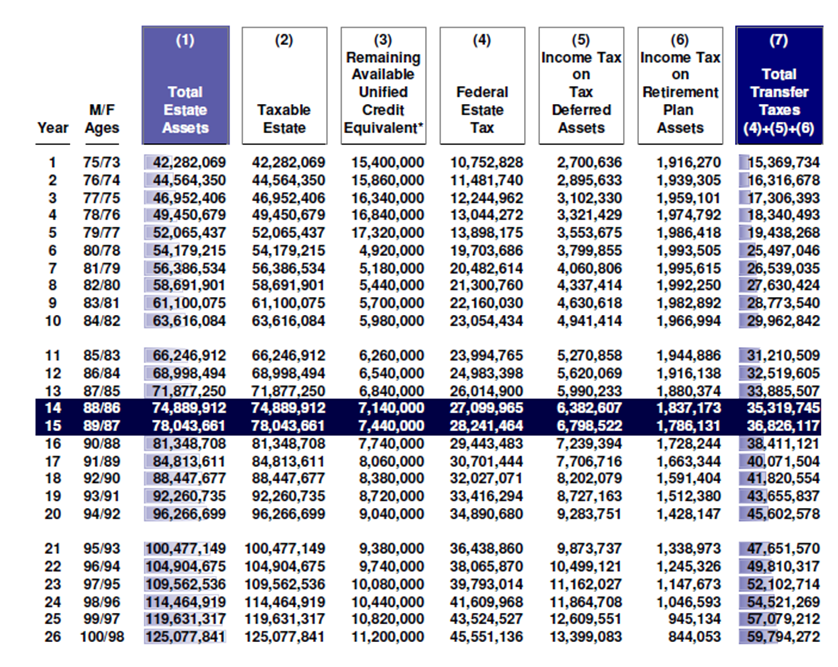

After a detailed discussion with the investment advisor, a projection of the estate was completed including a cash flow analysis for living expenses. The income and estate tax projections are shown below year by year, with the blue highlighted rows indicating projected life expectancy.

Transfer Tax Details

We assumed that the Estate Tax regulatory regime will remain as is with the Sunset provision of the 2017 Tax Cut and Jobs Act reducing the available unified credit for estate tax purposes in January 2026 (Column 3 minus the $8,000,000 already gifted). There was no analysis of a reduced exemption based on the current administrations tax proposals, but clearly, this would trigger an even larger transfer tax.

Transfer Tax Challenge

While the estate tax is a challenge at just over $27,000,000 (see Column 4), what is often missed is the impact of the additional income tax due on Tax Deferred Assets (Column 5 – the Annuities) and Retirement Plan Assets (Column 6 – the IRAs). Combined, these result in an additional $8,220,000 in income taxes that would be paid by the beneficiaries of those assets. The resulting total transfer taxes paid at the death of both spouses is just over $35,000,000.

Finding Tax Efficiencies

Finding Tax Efficiencies

Upon seeing the transfer tax problem, we discussed options with the investment advisor to find ways to reduce the size of the taxable estate and begin to find tax efficiencies in the wealth transfer objectives of the clients.

AgencyONE’s process on these cases is to create scenario planning or modeling of various recommendations, which may include but not be limited to:

- Making additional gifts of assets to children or trusts;

- Accelerating distributions from qualified assets;

- Accelerating distributions from annuities;

- Making charitable donations; and

- Funding life insurance in a trust or trusts, which may include Spousal Lifetime Access Trusts.

Unique Challenges

This case presented some unique challenges because annuities cannot be transferred to another individual or entity, such as children or a trust, without triggering immediate recognition of gain and triggering a tax (I.R.C. Section 72(e)(4)(C)). Furthermore, qualified plan assets, such as IRAs, cannot be gifted to children or to a trust without it being deemed a taxable distribution. Both types of assets comprised over 60% of the gross estate for these clients.

Recommended Solutions

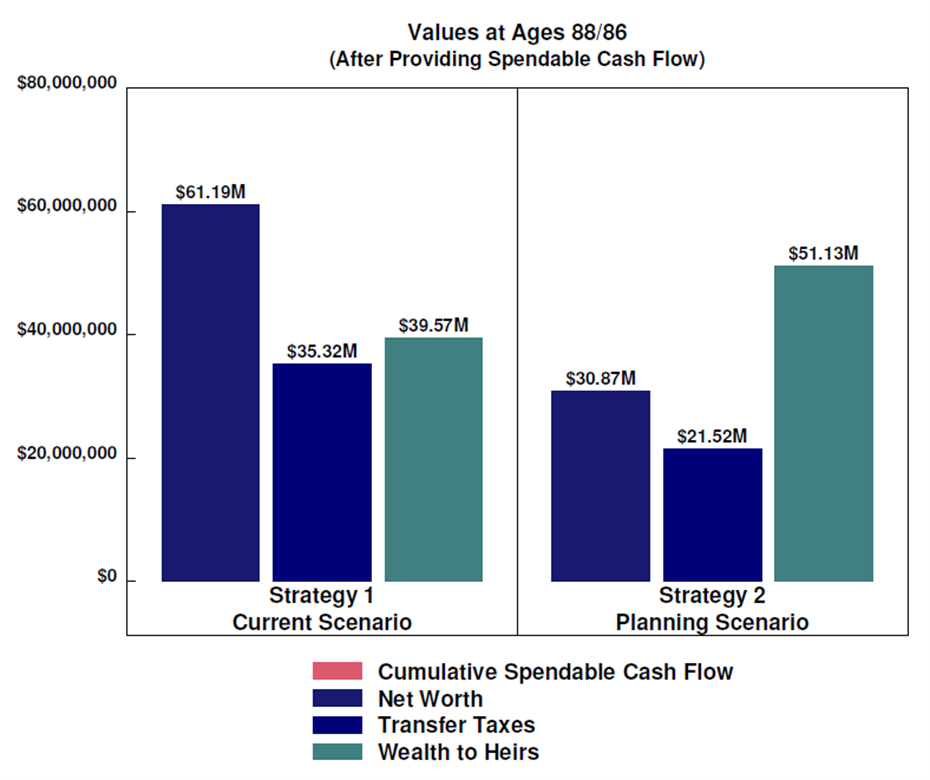

AgencyONE’s recommendations included transferring $10,000,000 of the clients non-qualified assets and accelerating IRA distributions to fund annual gifts to their trust to purchase $10,000,000 of 2nd to die life insurance on an abbreviated (5 years) premium flow. Without any additional planning, we were able to meaningfully reduce the clients’ taxable estate and provide the following enhancements to their wealth transfer after providing all lifestyle cash flow needs:

While we accelerated the income tax burden during the first 5 years of planning, by life expectancy the increased income tax paid over what would have otherwise been required by their RMDs was only $500,000, but the increased wealth transferred to their heirs was almost $12,000,000.

Dead Assets

IRAs and Tax-Deferred Annuities that are not spent down during one’s lifetime, as we see many wealthy individuals and families with large balances in both, are dead assets, with a possible income and estate transfer confiscation of 60% or more.

IN4FA has the expertise, analytic tools, and experience to assist investment and risk management advisors in completing this sort of analysis and proffering recommendations for consideration by the planning team.