The Financial Services Gap – Expected vs Received

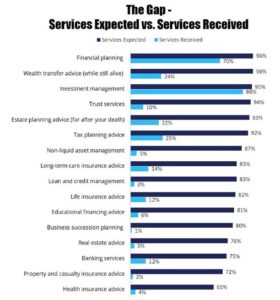

A real and very troubling gap exists in the financial services industry between the services your clients expect and the services they actually receive. The research firm, Spectrem Group conducted a study of wealthy investors in 2021. They asked these investors what services they received from their financial advisory\wealth management companies, as well as what they expected to receive as part of their overall wealth management services. See the results in the graph below.

I am not surprised that most financial advisors and wealth management firms provide investment management services, first, and financial planning services secondarily, in that order. Customers expect investment management and seem to be receiving it (95% expected to 88% received). Financial planning falls a bit shorter: 96% of customers expect this service from their advisor and receive it 70% of the time. After that, however, they are being woefully underserved with respect to their financial advice expectations. The financial services profession can do so much better than that, but collaboration will be critical to better serving consumers and hoping to meet their expectations.

Many financial advisors focus on investment management (portfolio construction, rebalancing, financial planning, retirement planning, etc.), while others focus on insurance (life, disability, long term care, etc.). It would appear from the study referenced above that the two rarely meet.

Please take a moment to revisit the graph above, study it carefully and think about your relationship with your best customers. How would they rank your service offering versus what they expect from you? Is there a meaningful gap in any area?

If your investment or wealth management services correlate with this study in:

- Wealth transfer advice (while still alive) – 96% expected, 24% received;

- Estate planning advice (after your death) – 93% expected, 22% received;

- Long-term care insurance advice – 83% expected, 14% received;

- Life insurance advice – 82% expected, 12% received; and/or

- Business succession planning – 80% expected, 1% received;

then you should consider collaboration with a risk management advisor. If you are a risk management advisor and do not offer investment management or financial planning, you should consider partnering with a wealth management firm.

A recent article in Kiplinger titled Insurance Can Make or Break Your Financial Plan by Roxanne Alexander discusses how a lawsuit, a storm, or a bad accident can ruin the best laid financial plans and how the correct property and casualty coverage can help shift some of that risk to insurance companies. We all buy car and homeowners insurance, as it is required before you can drive or own a home. Similarly, any of the following can have a devastating effect on financial plans if not properly made and executed:

Alexander discusses how a lawsuit, a storm, or a bad accident can ruin the best laid financial plans and how the correct property and casualty coverage can help shift some of that risk to insurance companies. We all buy car and homeowners insurance, as it is required before you can drive or own a home. Similarly, any of the following can have a devastating effect on financial plans if not properly made and executed:

- The loss of income due to the breadwinner’s inability to work because of a disability

- The loss of family income due to the pre-mature death of one or both breadwinners in a family unit

- The financial burden or caring for the elderly whether at home or a care facility

What impact would any of these have on your clients’ financial plans?

Clients’ expectations of their financial and wealth advisors are changing. The Spectrem Group has conducted a follow up research study entitled Wealth Management Redefined, which will provide new insights into how investors think about wealth management and what it means to them in today’s world.

Clients’ expectations of their financial and wealth advisors are changing. The Spectrem Group has conducted a follow up research study entitled Wealth Management Redefined, which will provide new insights into how investors think about wealth management and what it means to them in today’s world.

Meeting client expectations, especially for higher income and net worth clients, is critical to the long-term success of a thriving financial services practice. If you do not have collaborative or outsourced partnerships with other disciplines in the financial services industry, you should. Your client’s well-being and that or your business may depend upon it.