Why Fee Advisors Should Consider No Load/ Low Load VULs

Let us start with the obvious – he or she would NOT because without a FINRA registration and a Broker Dealer, the Fee Only RIA is not licensed to sell a VUL – it is, after-all, a registered product solution. With a Fee Based or “Hybrid” Advisor, that is a different conversation and I will discuss this later.

WHAT IF I TOLD YOU THAT YOU COULD RECOMMEND A VUL?

AND what if I told you that you could construct the portfolio (within the available fund options), manage the portfolio, aggregate values for reporting purposes AND continue to charge your client per your customary fee agreement (whether you are Fee Only or Fee Based), all the while eliminating taxes on reinvested dividends and capital gains for the life of the client? What if I also told you that you could add Alpha to your client’s Variable Universal Life policy portfolio? And finally, what if I told you that existing life insurance policy cash values (of any kind), not managed by you, could be brought into your AUM via a tax-free transfer while preserving the cost basis? Does this sound impossible? Please keep reading.

The immediate objection to Variable Universal Life from a Registered Investment Advisor’s perspective is that those assets (the cash value) fall outside of the control of the RIA. If it cannot be reported in the aggregate statement, it may not be considered part of the AUM fee agreement. Which means that the fee, let’s call it 1%, cannot be billed to the client. We have solved that problem.

ISN’T LIFE INSURANCE IS TOO EXPENSIVE?

ISN’T LIFE INSURANCE IS TOO EXPENSIVE?

The next objection is that life insurance is expensive – that it has too high of an expense drag. Let me do the math for you because that could not be further from the truth. In fact, in a managed portfolio, I hope that you will agree that the largest expense to a client’s portfolio is taxes on reinvested dividends and capital gains, not always fund management expenses, even if you only invest in a low-cost index fund such as an S&P Index (Vanguard as an example, has a .04% expense ratio). Clearly, in an actively managed or traded portfolio, the tax bite could be even greater due to capital gains, but so are the management fees.

Dividends are generally taxed at ordinary income tax rates that can be as high as 37% for federal taxes in 2021 under current law plus any applicable state taxes.

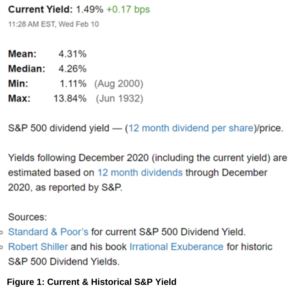

The S&P Index Yield, from 1871 to 2020, has averaged (mean) 4.31% with a median of 4.26%. As of the date of this writing, it is currently yielding around 1.5%, which is historically low.

So, for example, on a $1,000,000 account balance for a high income\high net worth client, in an S&P 500 Index account, the historical average dividend would be $43,100 and at a 35% tax rate “the cost” is just under $15,100 in taxes.

Then add the .04% fund level fee of $400 at Vanguard for a total of 1.55% or $15,500. If you then add a fee for the advisor, suddenly it gets very expensive to own a Vanguard Index Fund. Take a zero off the account balance and the math works just the same.

If you move into a more actively managed account that generates meaningful capital gains taxed at 20% for federal tax purposes (but the tax could be almost double depending on whether they are short term or long-term capital gains) and may also be subject to state taxes, the dynamics change even further. You get it.

Objection number two has been solved. Life insurance is NOT expensive compared to a non-qualified investment account. BUT WHAT ABOUT THE INSURANCE COSTS? More on this shortly – I promise.

VARIABLE LIFE INSURANCE POLICIES PROVIDE A “TAX WRAPPER”

Fundamentally, any dividends and capital gains are protected from taxation to the owner of the policy much like in a qualified plan (401K, IRA or Roth), taking the cost of taxes out of the equation. Furthermore, life insurance enjoys a special regulatory tax treatment under the law during the distribution phase in that it allows the policy owner to take basis (sum of premiums\contributions invested in the policy) from the policy FIRST, and then borrow any gains from the policy TAX FREE. Finally, should the client die, the death benefit is paid INCOME TAX FREE without regard to basis – in effect, a guaranteed step up in basis. Double finally, if the client is in a wealth transfer tax (yes, “death tax”) situation, properly structured, the death benefit can be free of any estate taxes.

Let me say that again …. the policy owner enjoys:

- Tax free dividends

- No taxes due on capital gains

- First in, first out (FIFO) taxation treatment\ access to the account values

- Income tax free loans at a very low or no cost

- No pre-59 ½ penalties on withdrawals

- A guaranteed step up in basis, not on the account value but on the death benefit at death

- Possible exclusion from wealth transfer taxes.

I don’t know about you, but that sounds fairly attractive to me.

THE COST OF LIFE INSURANCE & AGENT/ REGISTERED REPRESENTATIVE COMMISSIONS

Now, let’s discuss the big white elephant in the room – the cost of the life insurance AND agent\ registered representative commissions.

Now, let’s discuss the big white elephant in the room – the cost of the life insurance AND agent\ registered representative commissions.

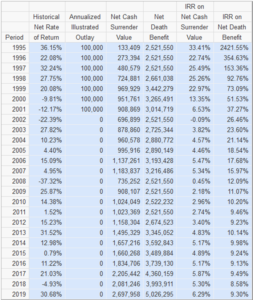

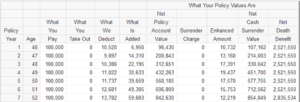

I have prepared a variable life illustration and have shown the historical performance of the policy assuming that it had been invested in the S&P Index Sub-Account of this policy since 1995 through the end of 2019. Notice the first-year cash surrender value and how it does not reflect any surrender charges and captures almost the full amount of the return of the S&P in that year.

The illustrated policy is for a 45-year-old male, healthy non-tobacco user and is designed for maximum accumulation and minimum cost of insurance to avoid becoming a Modified Endowment Contract; thereby maintaining its favorable tax status.

The objective of the policy design is to maximize efficiency within the constraints of the tax law and to minimize expense drag.

In the table below, I have added a summary expense page (a detailed one is also available and is also disclosed in the full illustration). Clearly there are deductions; it is life insurance first and foremost. In the “What We Deduct” column, these charges are for premium taxes, administrative charges, cost of insurance and any riders, acquisition costs, and underwriting costs. There is also an “Enhanced Amount” column that fundamentally reimburses the client for these charges should they surrender the contract and is added back to the Net Cash Surrender Value. The column titled “What is Added” shows the illustrated returns net of any sub-account expenses, and as previously mentioned are not taxable annually to the client, and potentially are NEVER taxable.

A SPECIAL VARIABLE UNIVERSAL LIFE SOLUTION

The solution that I am introducing to you can be designed with ZERO agent commissions. It does, however, pay a modest wholesale dealer concession to a Broker Dealer of the designated registered representative. A registered representative is required to sell a Variable Universal Life policy. IN4FA’s back office – AgencyONE – has a wholesale broker dealer who has agreed to register these accounts and allow our registered principal, who is also insurance licensed, to act as the servicing agent. IN4FA also has a network of insurance advisors who can act in this capacity nationally if you so choose. IN4FA, and its licensed representatives, do not manage money and would be required to sign non-solicitation and non-circumvention agreements with the referring Investment Advisor.

If you are an advisor who accepts securities commissions through your broker dealer, this solution has the flexibility to accommodate this scenario, with comparable efficiencies. All that would be needed is for your broker dealer to have a selling agreement with the insurance company.

I mentioned at the beginning of this article that fee-only advisors do not have the ability (nor the desire) to receive commissions on securities. There are solutions in the market, such as the one illustrated, that DO NOT pay a commission to the advisor. These solutions, however, allow the advisor to treat life insurance cash value as any other asset in a client’s portfolio and provide advisory services and charge a fee for doing so.

A Variable Universal Life policy prior to today was often a “set it and forget it” asset. Many registered representatives who are also licensed to sell insurance would establish an initial asset allocation strategy for the VUL portfolio and rarely manage them, often leaving clients to their own worst tendencies. Additionally, I cannot tell you how many VUL policies I have reviewed that after years of being issued, the portfolio was still in the fixed account or the money market equivalent account. Why and how did this happen? Because it was set up as a holding place for the investment until the portfolio could be determined …. and it never was. A Registered Investment Advisor can add tremendous value to a client’s tax deferred (cash value) portfolio.

forget it” asset. Many registered representatives who are also licensed to sell insurance would establish an initial asset allocation strategy for the VUL portfolio and rarely manage them, often leaving clients to their own worst tendencies. Additionally, I cannot tell you how many VUL policies I have reviewed that after years of being issued, the portfolio was still in the fixed account or the money market equivalent account. Why and how did this happen? Because it was set up as a holding place for the investment until the portfolio could be determined …. and it never was. A Registered Investment Advisor can add tremendous value to a client’s tax deferred (cash value) portfolio.

As a financial advisor to your clients, it would be your responsibility to establish the portfolio allocation, manage it, report on it and aggregate values in the overall portfolio that you manage for your clients. Technology has been built to allow daily values reporting through a portal, much like you would find in a qualified plan offering or on any other technology platform with which you may be familiar.

This institutionally priced Variable Universal Life solution does have some minimums, but unlike Private Placement Variable Life, it is generally available to most mass affluent or high net worth clients. The important issue is that YOU are in control of the asset and YOU are in control of the client.